Credit Scoring Course

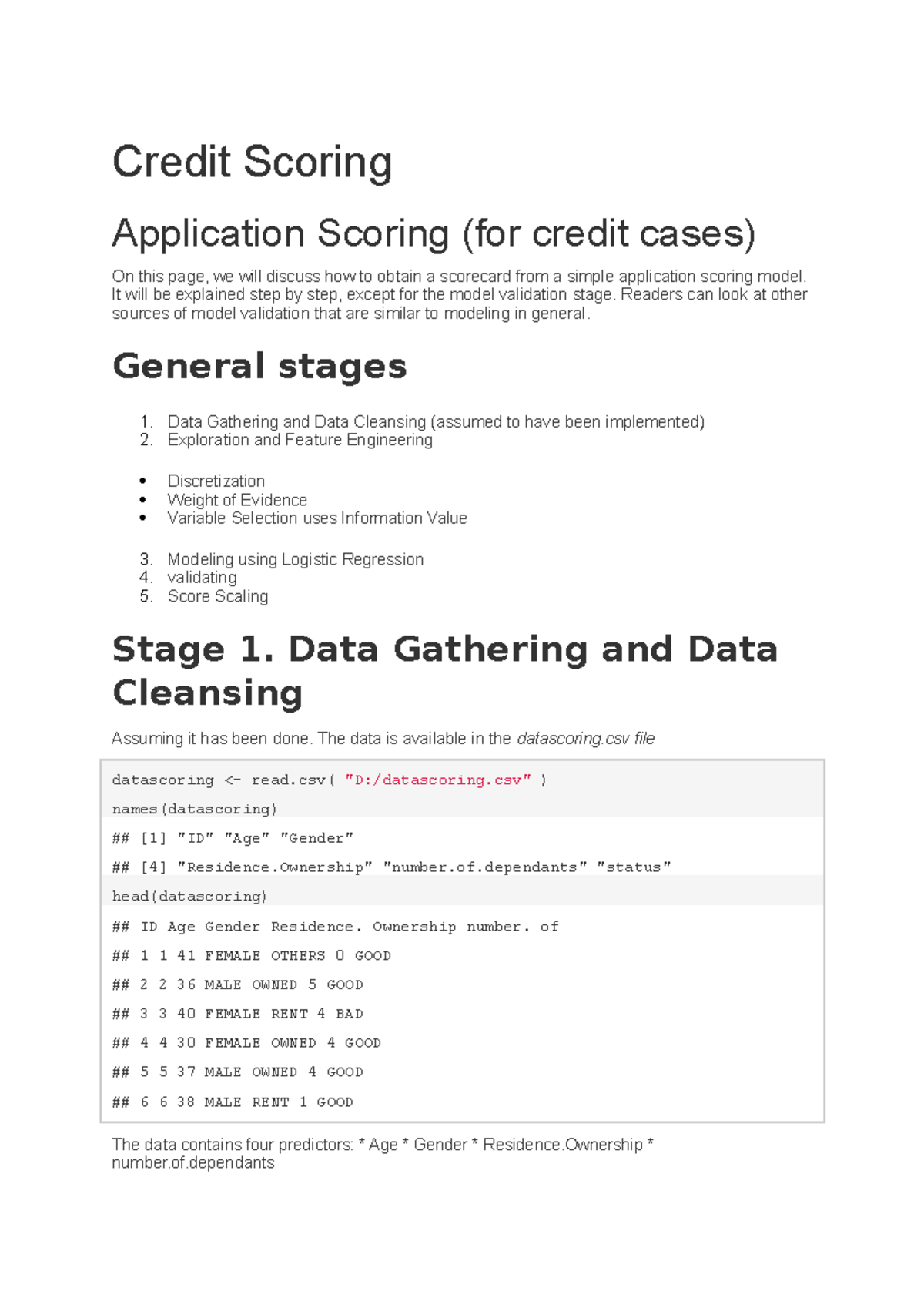

Credit Scoring Course - A variety of food and. Up to 10% cash back this is a comprehensive project based course where you will learn step by step on how to build a credit risk assessment and credit scoring model using logistic. The session will also include an. A comparison / gary g. Scoring applications / william m. It considers a range of issues that impact on how we implement and use. Credit training courses enable professionals to identify risks, make accurate credit judgments, and align lending transactions with their organization's risk appetite. Credit is reviewed after an admitted student submits their enrollment. Through interactive exercises and learning. Participants will gain practical insights into how these metrics help with credit decisions and contribute to evaluating a company's financial health. Up to 10% cash back this course will give you everything you need to know about fico credit scoring, debt collection defense, and how to “fix” your credit report. Click the links to learn more about requirements. This introductory online course provides the basics of credit reports, credit scoring and how both are used by lenders to determine access to credit. Participants will gain practical insights into how these metrics help with credit decisions and contribute to evaluating a company's financial health. I normally did my schoolwork at night when i was off from. One way to receive college credit is by scoring high enough on advance placement (ap) and international baccalaureate (ib) exams. Scoring applications / william m. At liv golf, every score counts towards both individual and team titles. Up to 10% cash back one of my areas of expertise is credit scores, and i’ve put together this quick course to bring you up to speed on everything you need to know on the subject. It's a free tool for students! We will go over the history. No credit card neededofficial credit bureau$1m id theft protection One way to receive college credit is by scoring high enough on advance placement (ap) and international baccalaureate (ib) exams. Up to 10% cash back this is a comprehensive project based course where you will learn step by step on how to build a credit. It considers a range of issues that impact on how we implement and use. The session will also include an. Are you ready to enhance your career in the financial world by mastering credit risk management skills? 18% increased their credit score (52 points on average). Enroll now and start your journey. Some schools offer specific ap or ib courses, but you. It will look at credit scoring, the most common set of techniques for managing and controlling consumer credit risk. Up to 10% cash back join us and take the next step in your career by mastering the skills needed to excel in credit risk scoring and decision making. Our “credit. Enroll now and start your journey. Credit training courses enable professionals to identify risks, make accurate credit judgments, and align lending transactions with their organization's risk appetite. One way to receive college credit is by scoring high enough on advance placement (ap) and international baccalaureate (ib) exams. Up to 10% cash back join us and take the next step in. No credit card neededofficial credit bureau$1m id theft protection The lowest score wins individually and only one team takes the crown. “overall, the credits were extremely affordable and allow for flexibility to take the courses after normal working hours. Transferology shows how courses you have taken or plan to take transfer to another college or university for credit. Up to. Up to 10% cash back join us and take the next step in your career by mastering the skills needed to excel in credit risk scoring and decision making. It considers a range of issues that impact on how we implement and use. Are you ready to enhance your career in the financial world by mastering credit risk management skills?. Up to 10% cash back you need only to have the desire to save money, improve their credit score and get on the road to financial freedom by utilizing the credit system to your advantage. Participants will gain practical insights into how these metrics help with credit decisions and contribute to evaluating a company's financial health. Our “credit risk scoring. Credit is reviewed after an admitted student submits their enrollment. Up to 10% cash back you need only to have the desire to save money, improve their credit score and get on the road to financial freedom by utilizing the credit system to your advantage. A variety of food and. Transferology shows how courses you have taken or plan to. Illinois institute of technology awards credit for the below programs. One way to receive college credit is by scoring high enough on advance placement (ap) and international baccalaureate (ib) exams. Up to 10% cash back one of my areas of expertise is credit scores, and i’ve put together this quick course to bring you up to speed on everything you. It's a free tool for students! Up to 10% cash back one of my areas of expertise is credit scores, and i’ve put together this quick course to bring you up to speed on everything you need to know on the subject. “overall, the credits were extremely affordable and allow for flexibility to take the courses after normal working hours.. Up to 10% cash back one of my areas of expertise is credit scores, and i’ve put together this quick course to bring you up to speed on everything you need to know on the subject. Up to 10% cash back you need only to have the desire to save money, improve their credit score and get on the road to financial freedom by utilizing the credit system to your advantage. One way to receive college credit is by scoring high enough on advance placement (ap) and international baccalaureate (ib) exams. I normally did my schoolwork at night when i was off from. It considers a range of issues that impact on how we implement and use. Illinois institute of technology awards credit for the below programs. Are you ready to enhance your career in the financial world by mastering credit risk management skills? Some schools offer specific ap or ib courses, but you. A comparison / gary g. Transferology shows how courses you have taken or plan to take transfer to another college or university for credit. It will look at credit scoring, the most common set of techniques for managing and controlling consumer credit risk. Scoring applications / william m. 18% increased their credit score (52 points on average). Credit training courses enable professionals to identify risks, make accurate credit judgments, and align lending transactions with their organization's risk appetite. This introductory online course provides the basics of credit reports, credit scoring and how both are used by lenders to determine access to credit. We will go over the history.Credit Scoring Application Scoring for credit cases Credit Scoring

Improving Your Credit Score St. Pauls College

Credit Scoring Using Machine Learning WeCloudData

Build & Boost Your Credit Score Online Course

Different Types Of Credit Scoring Model Credit Scoring And Reporting

Understanding Credit Reports ppt download

A powerful and accurate Credit Scoring Machine Learning Model Upwork

Understanding and Improving Your Credit Score A Guide

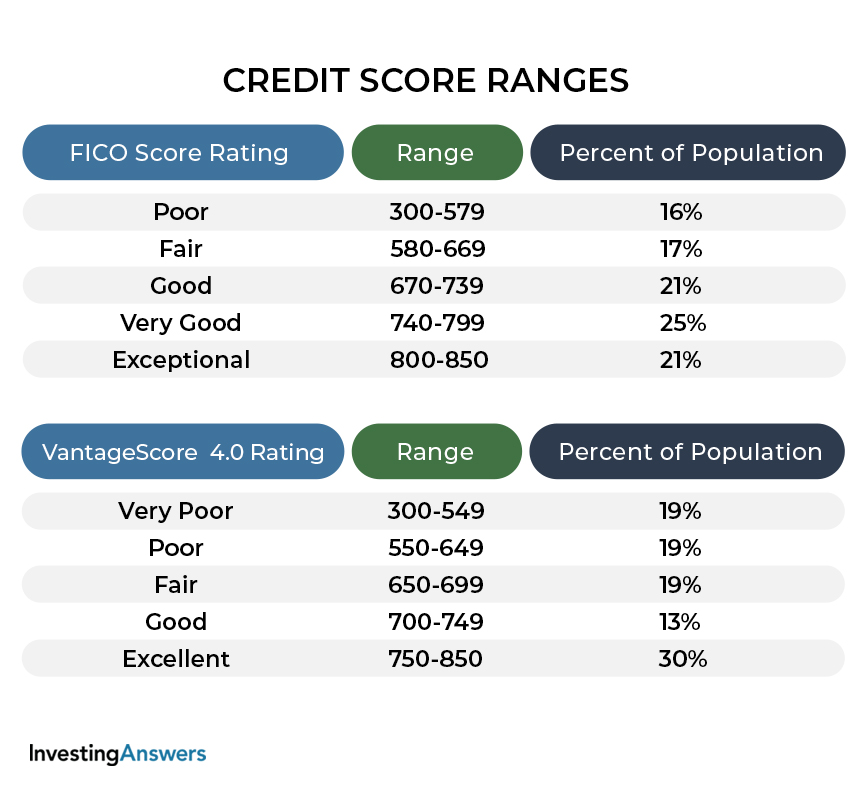

Your Guide to Building the Best Credit Scores InvestingAnswers

A Complete Credit Scoring Sheet For Faster Credit Review

Through Interactive Exercises And Learning.

The Lowest Score Wins Individually And Only One Team Takes The Crown.

Enroll Now And Start Your Journey.

It's A Free Tool For Students!

Related Post: