During The Course Of An Insurance Transaction

During The Course Of An Insurance Transaction - Transaction of matters subsequent to effectuation of a contract of insurance and arising out of it (delivery of the policy,. Do not misrepresent the provisions of the policy d. During the course of an insurance business transaction, who does the producer legally represent? If an insurance agent makes a false or incomplete statement during the course of an insurance transaction, they could be found guilty of misrepresentation. Submit premiums collected to the insurer in a timely manner The correct answer is c. A producer acts as a liaison between the. This untrustworthy behavior can lead to significant financial and legal consequences. In the context of insurance transactions, making an untrue or incomplete statement can lead to serious legal consequences. In florida, a health policy that is paid on a quarterly basis requires a grace period of 31 days during the course of an insurance transaction, if an agent makes a false or incomplete statement, he/she could be found guilty of misrepresentation the coordination of benefits (cob) provision exists in order to avoid duplication of benefit payments. They act on behalf of the insurance company, meaning their primary legal obligation is. Submit premiums collected to the insurer in a timely manner highlight the protections guaranteed by the guaranty association be fair and honest do. Misrepresentation refers to providing misleading or inaccurate information intentionally or unintentionally. Is the maximum amount he would receive for an approved claim? A number of steps must be taken before an insurance transaction can be completed. During the course of an insurance transaction, which of the following is not a duty of the producer? Their role involves facilitating policy sales while primarily serving the company's interests. Do not misrepresent the provisions of the policy d. In insurance transactions, producers legally represent the insurance company, not the insured. A producers must notify the commissioner of insurance within ___ days of an address change. In insurance transactions, producers legally represent the insurance company, not the insured. Misrepresentation, which involves a producer knowingly making false statements during insurance transactions. In florida, a health policy that is paid on a quarterly basis requires a grace period of 31 days during the course of an insurance transaction, if an agent makes a false or incomplete statement, he/she. During the course of an insurance transaction, if a producer makes a false or incomplete statement, he/she could be found guilty of. The producer in an insurance business transaction legally represents the insurance company. In insurance transactions, producers legally represent the insurance company, not the insured. A number of steps must be taken before an insurance transaction can be completed.. During the course of an insurance transaction, which of the following is not a duty of the producer? This legal representation highlights the fiduciary responsibilities they hold towards the insurance provider. In florida, a health policy that is paid on a quarterly basis requires a grace period of 31 days during the course of an insurance transaction, if an agent. A number of steps must be taken before an insurance transaction can be completed. Transaction of matters subsequent to effectuation of a contract of insurance and arising out of it (delivery of the policy,. The correct term for this action is when a producer provides false information, which can mislead the client. The producer acts as the intermediary between the. Their role involves facilitating policy sales while primarily serving the company's interests. This untrustworthy behavior can lead to significant financial and legal consequences. During the course of an insurance transaction, which of the following is not a duty of the producer? A producers must notify the commissioner of insurance within ___ days of an address change. Submit premiums collected to. In florida, a health policy that is paid on a quarterly basis requires a grace period of 31 days during the course of an insurance transaction, if an agent makes a false or incomplete statement, he/she could be found guilty of misrepresentation the coordination of benefits (cob) provision exists in order to avoid duplication of benefit payments. During the course. Not the question you’re looking for? In this question, we need to determine who the producer legally represents during an insurance business transaction. If the insured is disabled for 3 1/2 months, what. And accidents and a monthly indemnity benefit of $500. These include making an application for insurance, underwriting the risk, and including all the steps required for forming. Here’s the best way to solve it. These can be broken down further to include: Here’s a breakdown of the producer's role: During the course of an insurance transaction, which of the following is not a duty of the producer? The producer in an insurance business transaction legally represents the insurance company. During the course of an insurance transaction, if a producer makes a false or incomplete statement, he/she could be found guilty of. Misrepresentation, which involves a producer knowingly making false statements during insurance transactions. Initially, the consumer and insurance company or insurance company’s agent must communicate to establish a contractual relationship. At its very simplest, the insurance transaction can be. Be fair and honest c. Misrepresentation, which involves a producer knowingly making false statements during insurance transactions. During the course of an insurance business transaction, who does the producer legally represent? Here’s the best way to solve it. Before an insurance policy can be issued, the prospective insured must apply to. Study with quizlet and memorize flashcards containing terms like during the course of an insurance transaction, if an agent makes a false or incomplete statement, he/she could be found guilty of_____, which of the following types of term life policies most likely contains a renewability feature?, the investment gains from a universal life. Not the question you’re looking for? During the course of an insurance business transaction, who does the producer legally represent? Here’s the best way to solve it. Misrepresentation refers to providing misleading or inaccurate information intentionally or unintentionally. In this question, we need to determine who the producer legally represents during an insurance business transaction. At its very simplest, the insurance transaction can be divided into the initial sale of the policy, and subsequent handling of claims. Before an insurance policy can be issued, the prospective insured must apply to. Here’s a breakdown of the producer's role: This legal representation highlights the fiduciary responsibilities they hold towards the insurance provider. A producers must notify the commissioner of insurance within ___ days of an address change. These include making an application for insurance, underwriting the risk, and including all the steps required for forming a valid contract. This untrustworthy behavior can lead to significant financial and legal consequences. During the course of an insurance transaction , if an agent makes a false or incomplete statement , he / she could be found guilty of The producer in an insurance business transaction legally represents the insurance company. A producer acts as a liaison between the.BOPIIP accounting for disaster insurance transactions Download

Insurance transactions between residents and crossborder Download

PPT Accounting Chapter 2 PowerPoint Presentation, free download ID

Insurance Policy Coverage Details Salesforce Trailhead

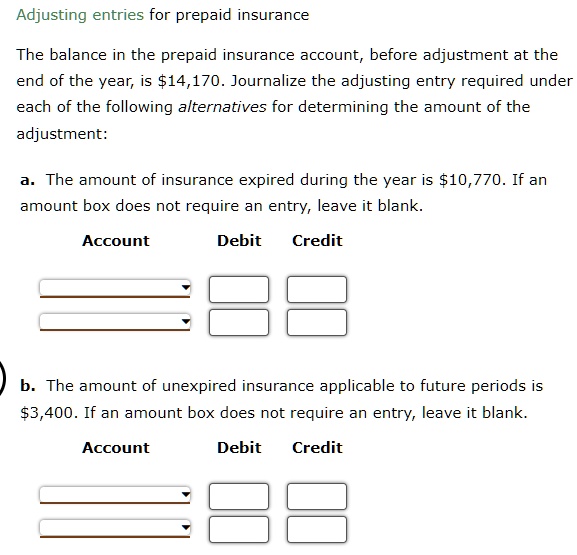

SOLVED Adjusting entries for prepaid insurance The balance in the

Premium Financing The Key To Closing The Big Cases

Top 7 Technologies that Improve Insurance Claims Processing

Explore Insurance Policy Coverage, Assets, and Transactions Unit

PBBF 303 FIN. RISK MANAGEMENT AND INSURANCE ppt download

Consideration In Insurance What Counts? ShunIns

And Accidents And A Monthly Indemnity Benefit Of $500.

In Insurance Transactions, Producers Legally Represent The Insurance Company, Not The Insured.

The Term Transacting Is Basically Anything That Needs To Be Done During The Purchase Process Of An Insurance Product.

Submit Premiums Collected To The Insurer In A Timely Manner

Related Post: