Hedge Fund Course

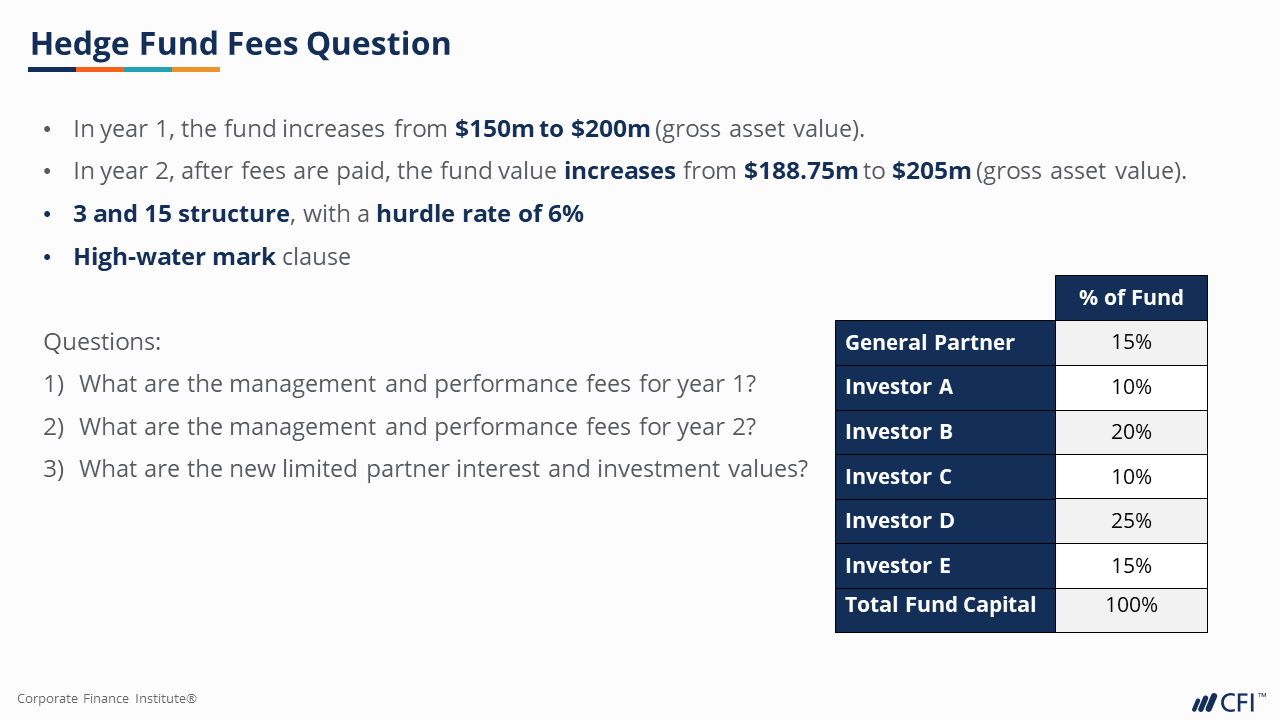

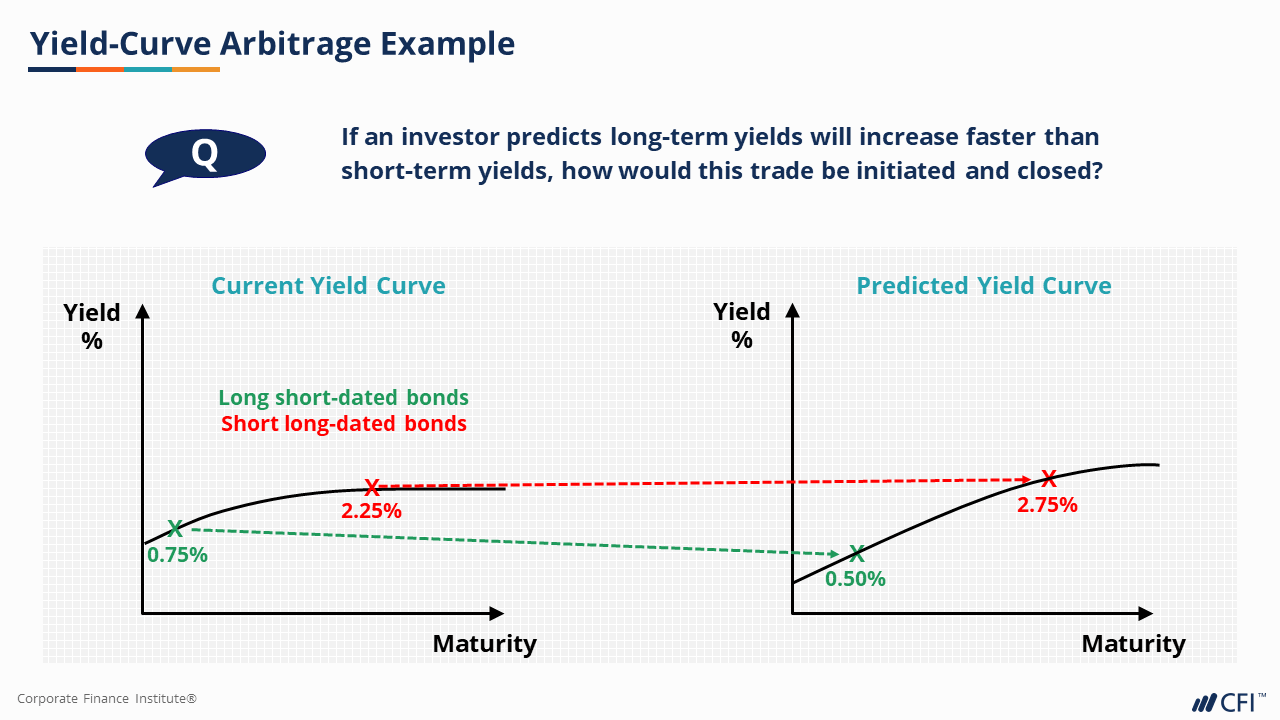

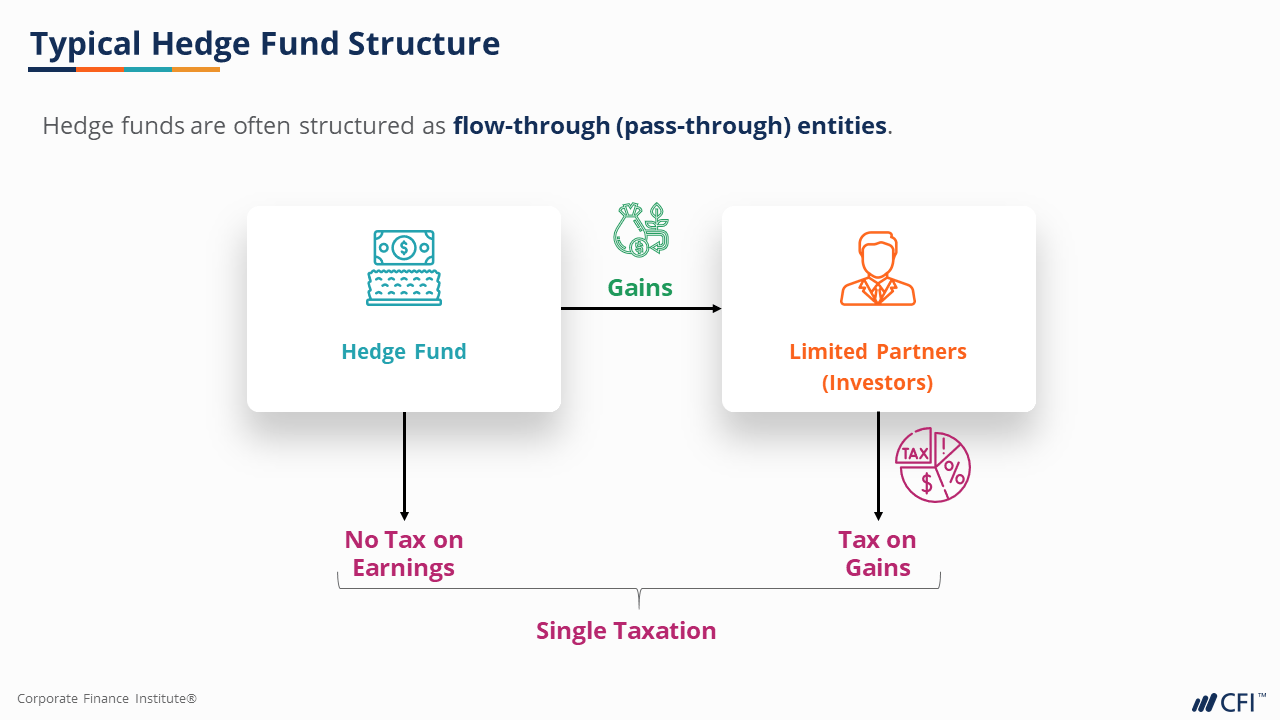

Hedge Fund Course - In this article, we are going to take a look at where alphabet inc. You will learn the common characteristics of hedge funds, how they are structured, and the mechanics of. Before a firm can start raising capital and trading, a solid strategic, financial, operational, and legal foundation will need to be. Understand how real estate differs. Direct ownership of alternative assets • 4 minutes; The role of alternative investments, specifically farmland, in a portfolio • 3 minutes; Transform you career with coursera's online hedge fund courses. In the 48th part of this series, riju mehta explains what hedge funds are and how they operate. Up to 10% cash back introduction to hedge funds, executing brokers and prime brokers, both synthetic (derivatives) and traditional, what they are, what they do and what risks are. What are the major hedge fund strategies and their mechanics? How important are hedge funds to investors, regulators, and the public?. Participants explore hedge fund structures, strategies and trends. Launching a hedge fund takes time and careful planning. Hedge funds are privately owned unlike etfs, rics, reits, and bond funds which are publicly traded vehicles. Enroll for free, earn a certificate, and build. Understand how and why hedge fund managers are so well paid; Up to 10% cash back discover how mba level courses in hedge funds are delivered. Transform you career with coursera's online hedge fund courses. Hedge funds and private equity firms typically structure their funds to avoid registration under the investment company act of 1940. In this nyif hedge fund online finance course, you'll learn about long/short equity, the oldest and the largest hedge fund strategy and more. Learn key elements of hedge funds, including fee structure and sources of risk and value, and understand and assess types of arbitrage and strategies. Up to 10% cash back introduction to hedge funds, executing brokers and prime brokers, both synthetic (derivatives) and traditional, what they are, what they do and what risks are. In the introductory level 1 course, chp. How important are hedge funds to investors, regulators, and the public?. In the introductory level 1 course, chp participants gain a thorough understanding of industry best practices, practical. Enroll for free, earn a certificate, and build. Before a firm can start raising capital and trading, a solid strategic, financial, operational, and legal foundation will need to be. Learn about hedge. What are the major hedge fund strategies and their mechanics? Hedge funds are privately owned unlike etfs, rics, reits, and bond funds which are publicly traded vehicles. Enroll for free, earn a certificate, and build. The role of alternative investments, specifically farmland, in a portfolio • 3 minutes; In this nyif comprehensive hedge funds online finance course, you'll learn strategies,. Understand how real estate differs. Two primary exemptions allow these. We recently published a list of 11 best augmented reality stocks to buy according to hedge funds. Recognize key aspects of the professional management of hedge fund portfolios. Up to 10% cash back introduction to hedge funds, executing brokers and prime brokers, both synthetic (derivatives) and traditional, what they are,. You will learn the common characteristics of hedge funds, how they are structured, and the mechanics of. Launching a hedge fund takes time and careful planning. Two primary exemptions allow these. How important are hedge funds to investors, regulators, and the public?. Before a firm can start raising capital and trading, a solid strategic, financial, operational, and legal foundation will. We recently published a list of 11 best augmented reality stocks to buy according to hedge funds. Learn about hedge fund strategies, risk management, and regulatory frameworks. Direct ownership of alternative assets • 4 minutes; What are their hidden risks and unique limitations? Mutual funds, hedge funds are minimally regulated. Before a firm can start raising capital and trading, a solid strategic, financial, operational, and legal foundation will need to be. What are the major hedge fund strategies and their mechanics? Explore how hedge funds are organized; Hedge funds are privately owned unlike etfs, rics, reits, and bond funds which are publicly traded vehicles. Understand how and why hedge fund. Two primary exemptions allow these. Up to 10% cash back introduction to hedge funds, executing brokers and prime brokers, both synthetic (derivatives) and traditional, what they are, what they do and what risks are. In this article, we are going to take a look at where alphabet inc. How important are hedge funds to investors, regulators, and the public?. Learn. Explore how hedge funds are organized; Direct ownership of alternative assets • 4 minutes; Learn key elements of hedge funds, including fee structure and sources of risk and value, and understand and assess types of arbitrage and strategies. Participants explore hedge fund structures, strategies and trends. Understand how real estate differs. Recognize key aspects of the professional management of hedge fund portfolios. How important are hedge funds to investors, regulators, and the public?. What are the major hedge fund strategies and their mechanics? Hedge funds and private equity firms typically structure their funds to avoid registration under the investment company act of 1940. Hedgeweek provides expert insights and news on hedge. The role of alternative investments, specifically farmland, in a portfolio • 3 minutes; Mutual funds, hedge funds are minimally regulated. In this nyif hedge fund online finance course, you'll learn about long/short equity, the oldest and the largest hedge fund strategy and more. How important are hedge funds to investors, regulators, and the public?. Then, you’ll learn to how put those lessons into. Understand how and why hedge fund managers are so well paid; In the introductory level 1 course, chp participants gain a thorough understanding of industry best practices, practical. Launching a hedge fund takes time and careful planning. Enroll for free, earn a certificate, and build. Up to 10% cash back discover how mba level courses in hedge funds are delivered. Direct ownership of alternative assets • 4 minutes; Transform you career with coursera's online hedge fund courses. Hedge funds are privately owned unlike etfs, rics, reits, and bond funds which are publicly traded vehicles. Recognize key aspects of the professional management of hedge fund portfolios. Learn about hedge fund strategies, risk management, and regulatory frameworks. Participants explore hedge fund structures, strategies and trends.4 Best Hedge Fund Courses [JAN 2025]

Hedge Fund Fundamentals I Finance Course I CFI

Hedge Fund Fundamentals I Finance Course I CFI

Hedge Fund Fundamentals Course Presentation PDF Investment Fund

The Hedge Fund Training Course

"Fundamentals of Hedge Funds" Course Preview EventDriven Strategies

5 Best + Free Hedge Fund Courses [Wharton CFI Yale] [2025 April]

Hedge Fund Fundamentals I Finance Course I CFI

5 Best Hedge Fund Courses [SEP 2023]

Hedge Fund Online Courses Inflection Point Intelligence

In This Nyif Comprehensive Hedge Funds Online Finance Course, You'll Learn Strategies, Hedge Fund.

We Recently Published A List Of 11 Best Augmented Reality Stocks To Buy According To Hedge Funds.

Two Primary Exemptions Allow These.

Before A Firm Can Start Raising Capital And Trading, A Solid Strategic, Financial, Operational, And Legal Foundation Will Need To Be.

Related Post:

![4 Best Hedge Fund Courses [JAN 2025]](https://s3.amazonaws.com/coursesity-blog/2023/10/Hedge.jpg)

![5 Best + Free Hedge Fund Courses [Wharton CFI Yale] [2025 April]](https://digitaldefynd.com/wp-content/uploads/2024/07/hedge-funds.jpg)

![5 Best Hedge Fund Courses [SEP 2023]](https://s3.amazonaws.com/coursesity-blog/2021/09/Hedge-Fund-Courses.png)