What Is Holder In Due Course

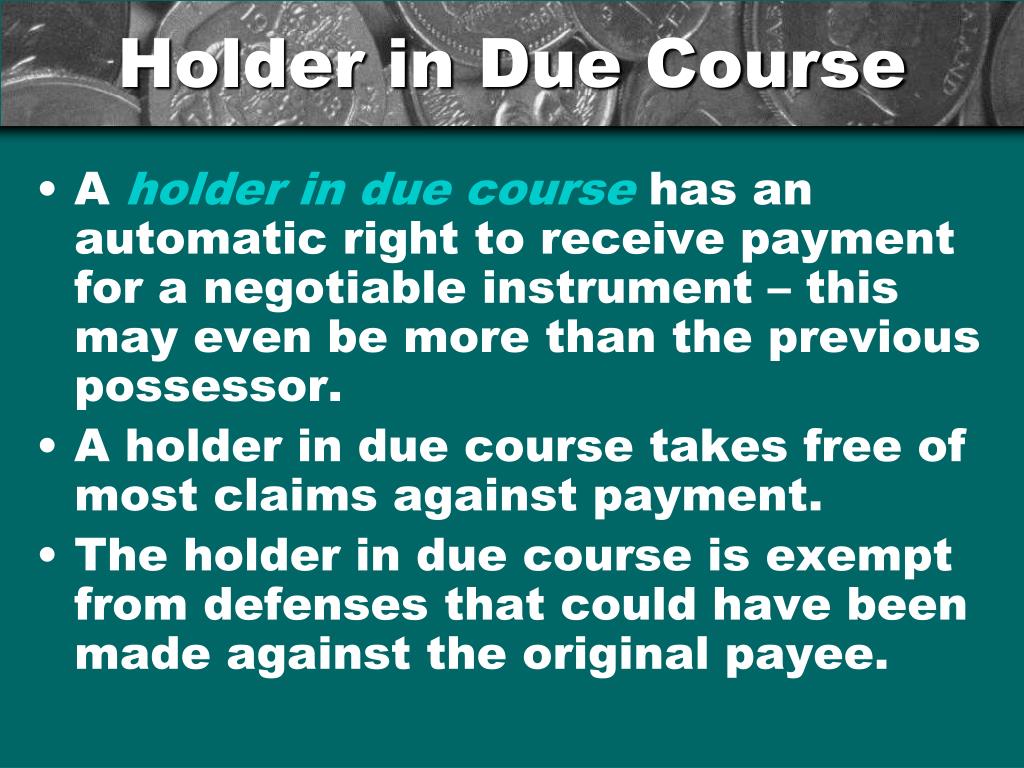

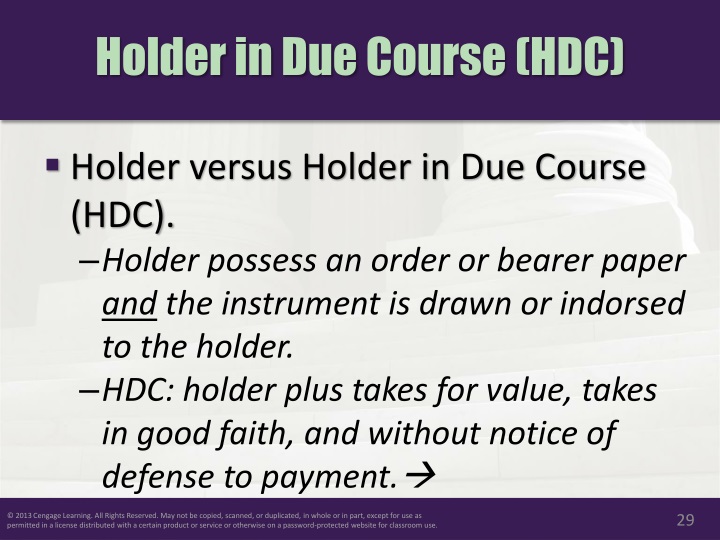

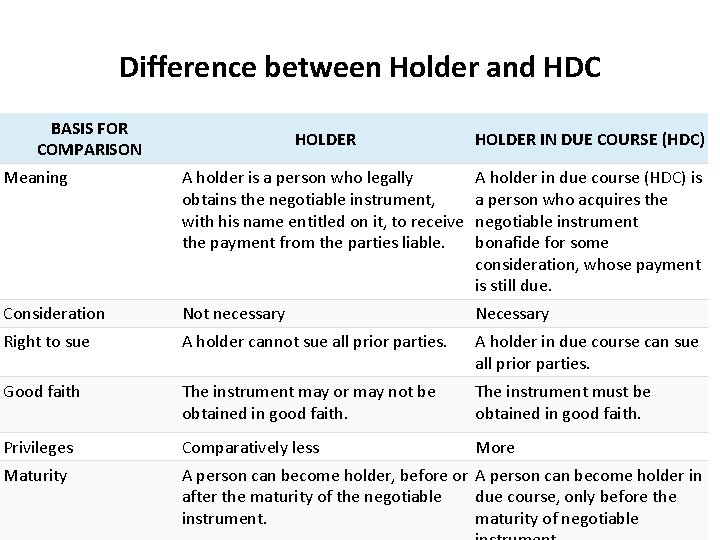

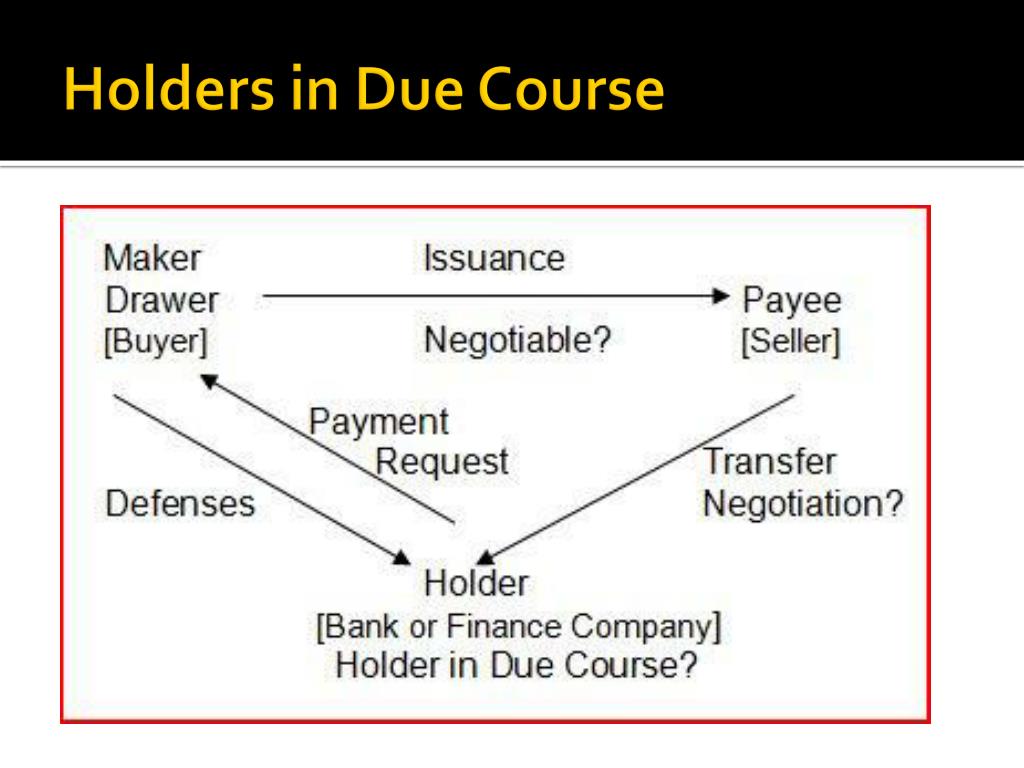

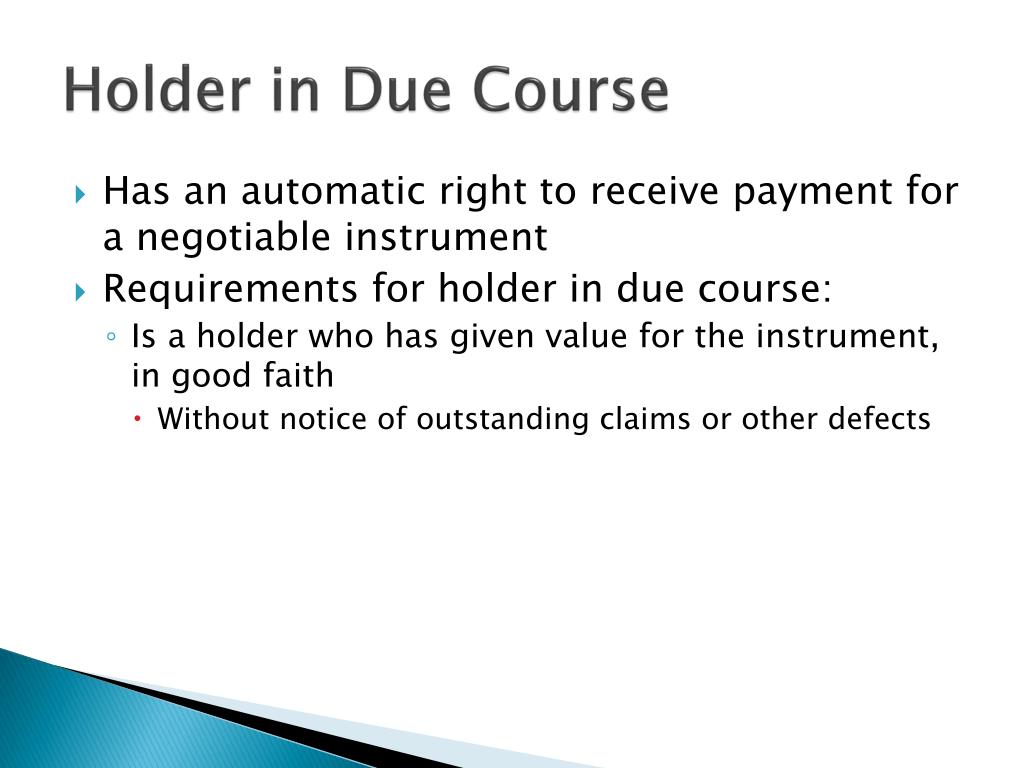

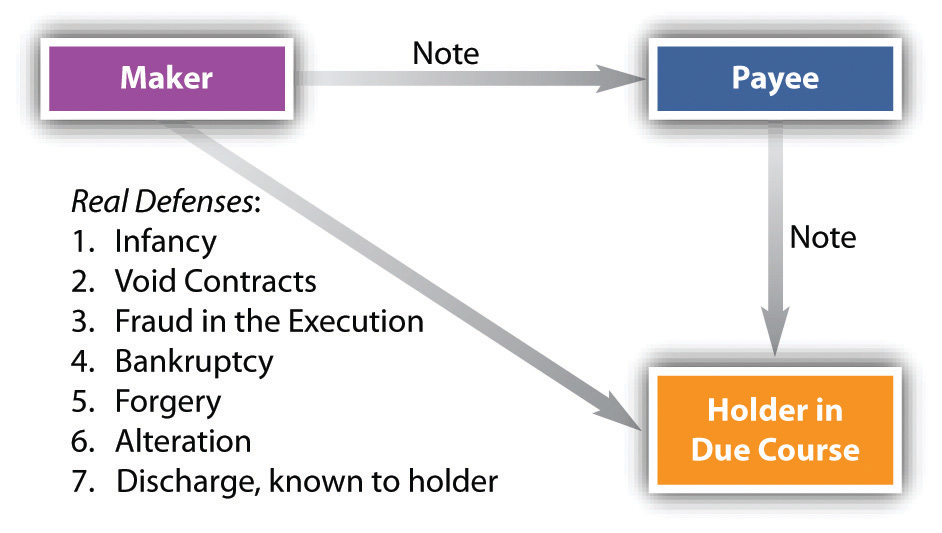

What Is Holder In Due Course - A holder in due course is someone who has obtained a negotiable instrument in a proper way. A 'holder in due course' is a term used in the world of finance and law. The rule often referred to as the holder in due course rule is actually titled preservation of consumer claims and defenses. it is a rule issued by the federal trade. This right shields a holder in due course from the risk of ta… The holder in due course is often considered innocent of any claims. It refers to a person who has received a specific type of document, known as a 'negotiable instrument', in good faith. According to section 9 of the negotiable instruments act, a. A holder in due course (hdc) is a specific type of holder of a negotiable instrument. A holder in due course is a person who acquires the instrument for consideration before maturity, in good faith, without knowing defects. If the instrument is later found not to be payable as written, a holder in due course can enforce payment by the person who originated it and all previous holders, regardless of any competing claims those parties may have against each other. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; It refers to a person who has received a specific type of document, known as a 'negotiable instrument', in good faith. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects or claims. What the holder in due course gets is an instrument free of claims or defenses by previous possessors. A 'holder in due course' is a term used in the world of finance and law. A holder in due course is a person who acquires the instrument for consideration before maturity, in good faith, without knowing defects. The holder in due course is often considered innocent of any claims. What is a holder in due course? A holder in due course is someone who has taken good faith possession of a negotiable instrument. This includes having it transferred to them, paying for it, and receiving it without knowing about. A holder with such a preferred position can then treat the instrument. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; This means that the holder. The ucc protects the rights of the hdc. The preservation of consumers’ claims. A holder in due course may or may not be the original lender, and often,. (1) the instrument when issued or negotiated to the holder does not bear such apparent evidence of forgery or alteration or is not otherwise so irregular or incomplete as to. A holder in due course is someone who exchanges something of value for the right. The preservation of consumers’ claims and defenses [holder in due course rule], formally known as the trade regulation rule concerning preservation of consumers' claims and. A holder in due course is someone who has obtained a negotiable instrument in a proper way. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good. The rule often referred to as the holder in due course rule is actually titled preservation of consumer claims and defenses. it is a rule issued by the federal trade. A holder in due course is someone who exchanges something of value for the right to collect on a debt. This includes having it transferred to them, paying for it,. (1) the instrument when issued or. Section under the ni act, 1881. A holder in due course may or may not be the original lender, and often,. What the holder in due course gets is an instrument free of claims or defenses by previous possessors. The ucc protects the rights of the hdc. It refers to a person who has received a specific type of document, known as a 'negotiable instrument', in good faith. What is a holder in due course? What the holder in due course gets is an instrument free of claims or defenses by previous possessors. A holder in due course may or may not be the original lender, and. According to section 9 of the negotiable instruments act, a. A 'holder in due course' is a term used in the world of finance and law. (1) the instrument when issued or negotiated to the holder does not bear such apparent evidence of forgery or alteration or is not otherwise so irregular or incomplete as to. Section under the ni. The preservation of consumers’ claims and defenses [holder in due course rule], formally known as the trade regulation rule concerning preservation of consumers' claims and. A holder in due course may or may not be the original lender, and often,. This means that the holder. Section under the ni act, 1881. What is a holder in due course? The preservation of consumers’ claims and defenses [holder in due course rule], formally known as the trade regulation rule concerning preservation of consumers' claims and. Section under the ni act, 1881. A holder in due course is someone who has taken good faith possession of a negotiable instrument. A holder in due course may or may not be the original. A holder in due course is someone who exchanges something of value for the right to collect on a debt. Section under the ni act, 1881. This right shields a holder in due course from the risk of ta… This means that the holder. A holder in due course is someone who has taken good faith possession of a negotiable. A holder in due course is a person who receives or holds a negotiable instrument, such as a check or promissory note, in good faith and in exchange for value. What is a holder in due course? The holder in due course is often considered innocent of any claims. This includes having it transferred to them, paying for it, and receiving it without knowing about. A holder in due course is someone who exchanges something of value for the right to collect on a debt. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; A holder in due course is the person or entity who is allowed to sue on the note to recover money due. A holder in due course is someone who has obtained a negotiable instrument in a proper way. If the instrument is later found not to be payable as written, a holder in due course can enforce payment by the person who originated it and all previous holders, regardless of any competing claims those parties may have against each other. It refers to a person who has received a specific type of document, known as a 'negotiable instrument', in good faith. A holder in due course is someone who has taken good faith possession of a negotiable instrument. The ucc protects the rights of the hdc. According to section 9 of the negotiable instruments act, a. (1) the instrument when issued or. A holder in due course is a person who acquires the instrument for consideration before maturity, in good faith, without knowing defects. The preservation of consumers’ claims and defenses [holder in due course rule], formally known as the trade regulation rule concerning preservation of consumers' claims and.PPT UCC 3 & 9A PowerPoint Presentation, free download ID6697270

PPT Chapter 16 Negotiability, Transferability, and Liability

Holder and Holder in Due course Dr Manish

PPT Holders in Due Course PowerPoint Presentation, free download ID

Holder in Due Course

Holder In Due Course Section 9 at Debi Combs blog

HOLDER IN DUE COURSE NEGOTIABLE INSTRUMENT.pptx

PPT Chapter 14 PowerPoint Presentation, free download ID7043922

Holder in Due Course and Defenses

Chapter 32 Negotiation and Holder in Due Course

A Holder In Due Course May Or May Not Be The Original Lender, And Often,.

Under Ucc Article 3, A Holder In Due Course Is Someone Who Acquires A Negotiable Instrument In Good Faith, For Value, And Without Notice Of Any Defects Or Claims.

A Holder In Due Course (Hdc) Is A Specific Type Of Holder Of A Negotiable Instrument.

This Means That The Holder.

Related Post: